Updated June 2024

In this section

Price Forecast Cases

Three cases for crude oil prices are presented in this section:

- The base-price case is a reference point based on assumptions, including a slowdown in global demand due to restrictive monetary policy, the Israel-Hamas conflict as well as the ongoing war in Ukraine, and global supply increase mainly driven by the U.S. shale output.

- The low-price case captures the lower limit of the 90% confidence interval.

- The high-price case captures the upper limit of the 90% confidence interval.

Highlights of 2023

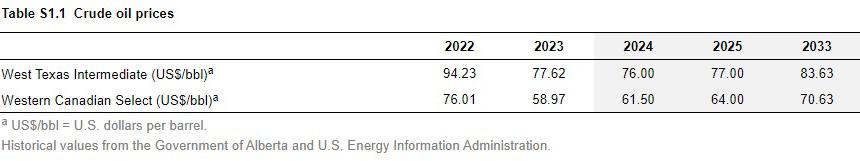

WTI: The West Texas Intermediate (WTI) price decreased by 18%, averaging US$77.62 per barrel (bbl) in 2023. The decrease was due to rising global inventories and concerns about the slow growth of global oil demand.

WCS: The Western Canadian Select (WCS) price decreased by 22%, averaging US$58.97/bbl.

The WCS price decrease was larger than the percentage decline in WTI, reflecting moderately wider price differentials in 2023 compared to the previous year.

Table S1.1 shows historical and forecast prices for crude oil.

Highlights of 2024 to 2033

Market Factors:

The forecast for 2024 assumes that crude oil prices will be influenced by a slowdown of global economic activity due to elevated interest rates, the ability of the Organization of the Petroleum Exporting Countries and its allied non-member countries (collectively referred to as OPEC+) commitment to restrict supply, growing U.S. and non-OPEC+ production, and heightened geopolitical risks. In 2025, global demand is expected to rebound with the resumption of global economic growth, while crude oil production growth keeps a lid on further gains in the WTI price. The market is expected to be mostly balanced by 2026, as demand for crude oil is expected to increase supply.

The long-term forecast largely depends on the demand for petroleum liquid fuels. Despite advances in environmental policies, there is still uncertainty about the timing of a decline in global crude oil demand.

WTI:

- Base-price case WTI: The forecast average price is US$76.00/bbl in 2024, strengthening to US$77.00/bbl in 2025. The price is expected to increase to US$83.63 in 2033.

- Low-price case WTI: The forecast is US$46.47/bbl in 2024 and projected to be US$46.45/bbl in 2033.

- High-price case WTI: The forecast is US$124.29/bbl in 2024 and projected to be US$150.54/bbl in 2033.

WCS:

- Base-price case WCS: The forecast price is US$61.50/bbl in 2024, rising to US$64.00/bbl in 2025. The price is expected to increase to US$70.63/bbl by 2033.

- Low-price case WCS: The forecast is US$33.92/bbl in 2024 and projected to be US$34.68/bbl in 2033.

- High-price case WCS: The forecast is US$111.51/bbl in 2024 and projected to be US$143.83/bbl in 2033.

Price differentials: In 2023, the WTI-WCS price differential averaged US$18.65/bbl. Figure S1.1 shows price differential for WCS relative to WTI.