Updated June 2024

Summary

After substantially increasing in 2022, the number of new wells placed on production in 2023 decreased by 20% as operators responded to declining oil prices, maturing basins, and elevated drilling costs due to inflation. A combination of high interest rates and a global economic slowdown prompted producers to adopt more conservative approaches compared with 2022. Nevertheless, anticipation of a decrease in interest rates and the start of the Trans Mountain Pipeline Expansion project suggests an uptick in drilling activity in 2024. Beyond that, from 2025 to 2033, the number of new wells placed on production is projected to remain relatively stable, gradually declining towards the end of the forecast but remaining significantly above the 2021 level. Companies are expected to continue to prioritize capital discipline.

Figure S4.3 shows the average daily production of crude oil and the number of new wells placed on production.

Well Activity in 2023

In 2023, 2760 new crude oil wells were placed on production compared with 3466 in 2022. Lower commodity prices and inflated capital and operating costs resulted in decreased drilling activity. Though the number of new wells placed on production declined, the average well length continued to increase, supporting higher productivity rates. In 2023, of all the new wells placed on production,

- 31 (about 1%) were vertical wells (a 55% increase from 2022) and

- 2729 (about 99%) were horizontal wells (over 20% decrease from 2022).

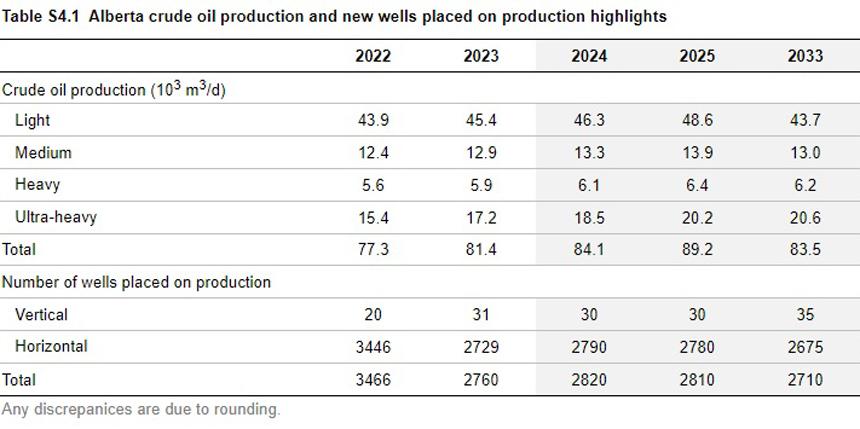

Table S4.1 shows the crude oil production and wells placed on production in 2022 and 2023 and includes forecasts to 2033.

Demand for crude oil is expected to remain relatively flat over the forecast period. However, producers continue disciplined capital spending by focusing on optimizing existing assets and reducing debt. Producers investing in new wells either targeted high-value light density crude oil or ultra-heavy crude oil that requires lower capital costs to place on production.

Producers continued to cut costs through advancements in drilling and completion, allowing some producers to drill longer wells in less time at a lower cost per metre. For horizontal wells using hydraulic multistage fracturing, the increased fracturing stages per well, longer well lengths, and multiple lateral legs resulted in higher production rates and slower decline rates.

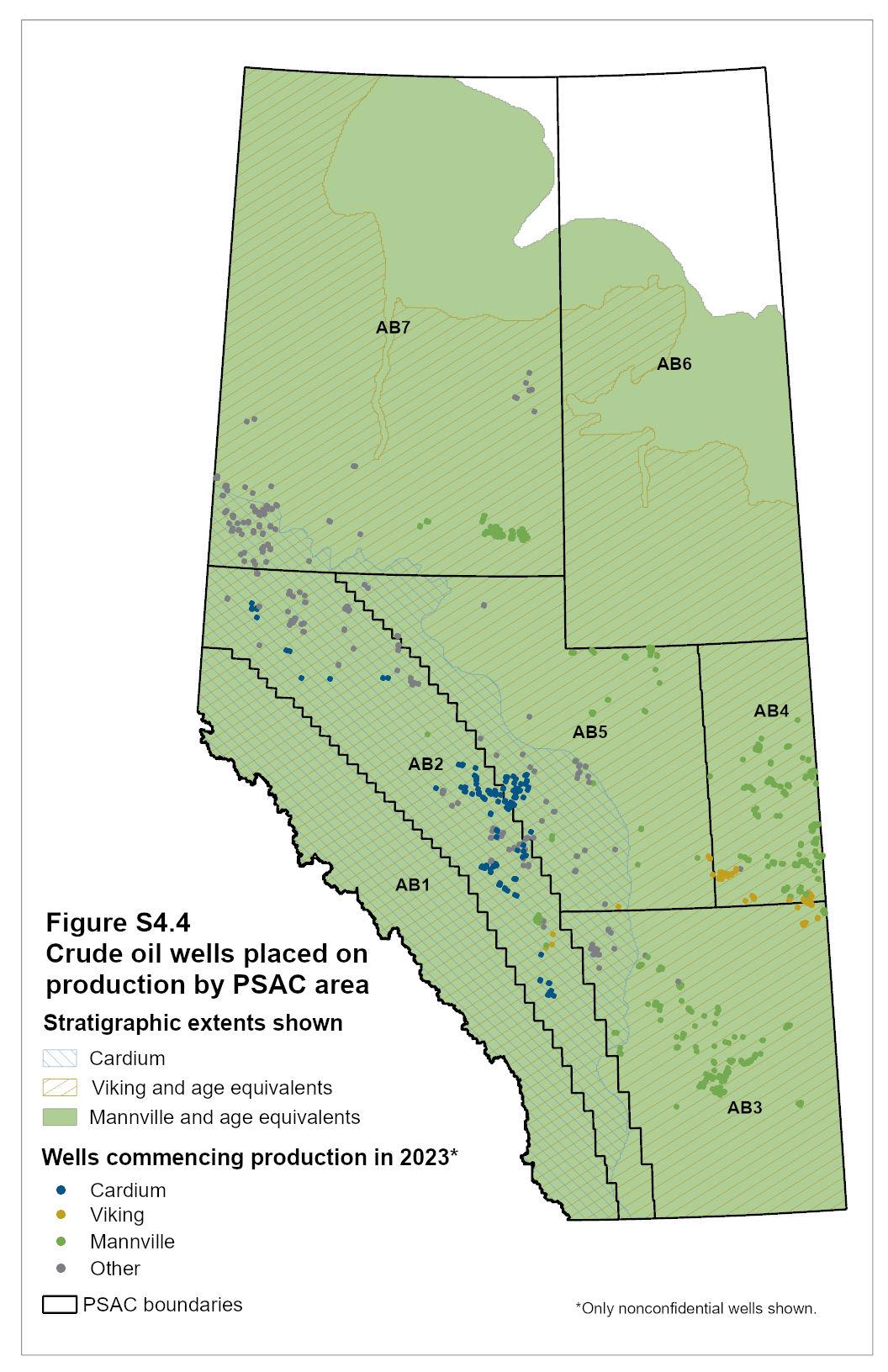

Figure S4.4 shows the wells placed on production in 2023 by Petroleum Services Association of Canada (PSAC) area and their distribution in the Cardium Formation, Viking Formation, and Mannville Group.

Forecast for 2024 to 2033

Between 2024 and 2033, the average total number of new oil wells placed on production is expected to be 2753 but will rise in the near term due to relatively favourable prices, ensuring reasonable profit margins for drilling activity. Producers are expected to continue targeting light crude oil because of its higher economic value or ultra-heavy crude oil due to more economic wells. Drilling activity is expected to remain robust in the Cardium Formation, Montney Formation, and Mannville Group.

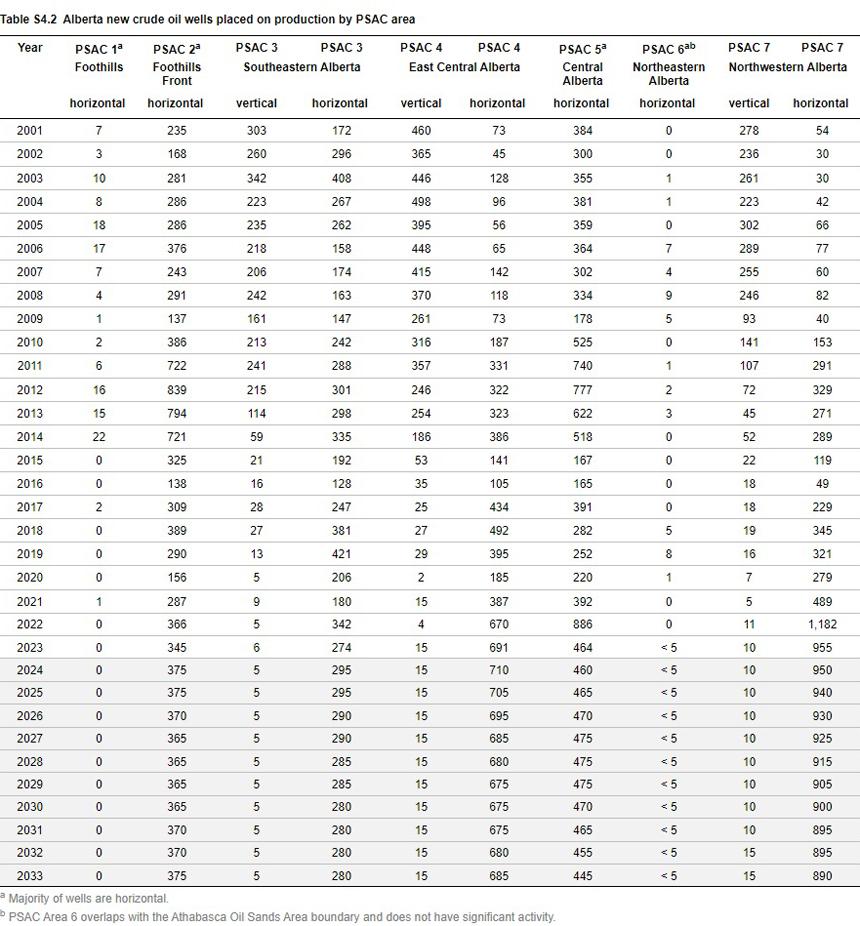

Table S4.2 shows the number of new crude oil wells placed on production by PSAC area and includes forecasts to 2033.

Learn More

- Methodology

- Data [XLSX]