Updated June 2024

The supply cost of a resource project is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, taxes, and earn a specified return on investment. Supply costs indicate whether a project is economically viable.

The most effective and cost-efficient completion technology used depends on the underlying geology. Supply costs vary significantly for different geological plays and the Petroleum Services Association of Canada (PSAC) areas because of

- differing production rates,

- well types,

- drilling and operating costs, and

- royalties.

Wells with a longer total measured depth, typically horizontal wells, tend to have higher initial productivity but also higher capital costs. However, the higher initial productivity of these wells will usually offset the higher capital costs, resulting in lower supply costs.

Wells drilled in the following PSAC areas tend to be horizontal and have higher initial productivity:

- Foothills Front (PSAC 2)

- Central Alberta (PSAC 5)

- Northwestern Alberta (PSAC 7)

Supply Costs by PSAC Area

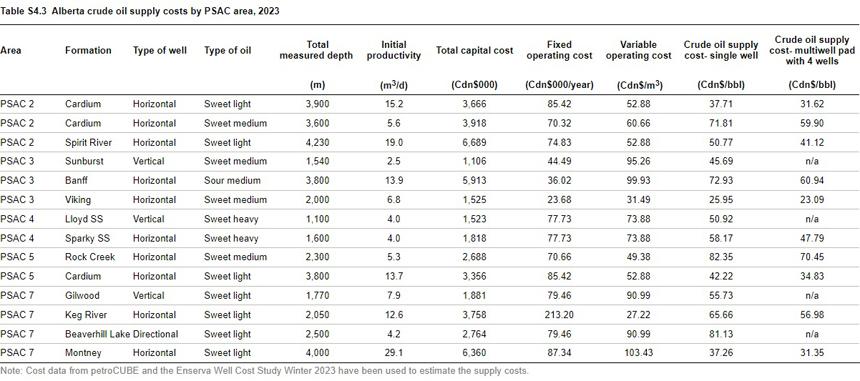

Table S4.3 shows the estimated supply costs for crude oil by PSAC area. These costs are based on 2023 capital and operating costs and representative production profiles. Companies often drill more than one well or lateral leg from a well pad (commonly referred to as a multiwell pad or multilateral well). These wells take advantage of economies of scale and typically incur lower capital costs, resulting in a lower cost per unit of output.

Supply costs in 2023 increased year over year by an average of 8%, mainly because of increased capital and operating costs. Drilling, casing, and completion costs increased across all PSAC areas. Higher associated drilling costs, such as service rigs, labour, production casing and cementing, completion fluids, fracture stimulation, transportation, and equipment rentals, also contributed to higher supply costs.

Learn More

- Methodology

- Data [XLSX]