Updated June 2024

Summary

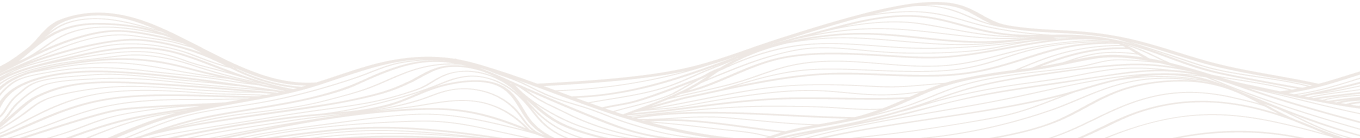

The average daily production of marketable natural gas in Alberta increased in 2023 to 315.0 million cubic metres per day (106 m3/d) or 11.2 billion cubic feet per day (Bcf/d), the highest production level since 2010, a 1.9% increase from the previous year. The higher production was driven by increases in gas production concentrated in the Petroleum Services Association of Canada (PSAC) Foothills Front (area 2) and Northwestern Alberta (area 7).

By 2033, marketable natural gas production is expected to reach 326.7 106 m3/d (11.6 Bcf/d). Production increases are expected across the Foothills Front and Northwestern Alberta. It is anticipated that these production gains to be partially offset by declines from other PSAC areas.

Figure S5.1 shows Alberta’s average daily marketable gas production by source and PSAC area.

Table S5.1 shows Alberta’s average daily marketable natural gas production and the number of new wells placed on production by year.

Marketable Gas Production in 2023

Figure S5.2 shows Alberta’s average daily production of marketable gas and the number of new producing wells.

Total conventional (including tight) gas production—defined here as gas production excluding coalbed methane (CBM) and shale gas—increased by 2.1% in 2023. Shale gas production increased by 0.3%, and CBM production decreased by 1.4% in 2023.

Forecast for 2024 to 2033

Three trends in natural gas production are expected to continue over the forecast:

- Gas producers will focus on the most productive plays within the province, reducing the need for as many new wells to maintain production levels compared with past practices.

- Liquids-rich plays attract the most attention given their higher profitability, resulting in higher natural gas liquids in the raw gas stream.

- Producers will continue to seek ways to optimize infrastructure use and lower their costs.

Given these trends, most new natural gas wells in Alberta are expected to come online in the Foothills Front and Northwestern Alberta PSAC areas. With growth in new wells placed on production, marketable gas production in Alberta is forecast to grow 3.7% by 2033. This production gain, however, is expected to be mildly offset by declines from other PSAC areas.

Oil Sands Gas Production and Use

Oil sands operations produce processed gas and produced gas. Processed gas is a by-product of bitumen upgrading, and its composition varies by process (e.g., coking versus. hydrocracking). Produced gas is raw natural gas from bitumen wells, and its composition varies depending on the source formation. Production trends for these gas sources are driven by bitumen production and upgrading.

Figure S5.3 shows the average daily gas production from bitumen upgrading and wells.

Oil sands operators use processed gas and produced gas for fuel and feedstock to generate electricity, steam, hot water for on-site operations, and hydrogen for upgrading units. Processed gas is also sent to processing facilities to extract high-value liquids.

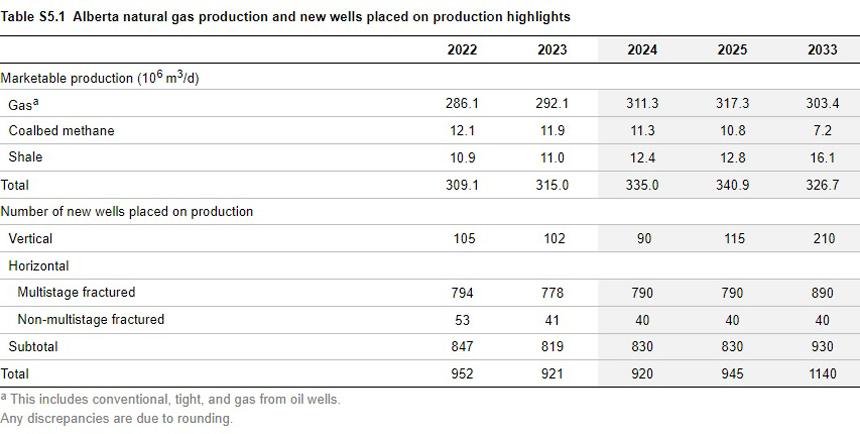

Operators also purchase large quantities of natural gas from external sources—termed “purchased gas”—for use in their operations. Oil sands operations account for over a quarter of the total natural gas consumption in Alberta (excluding gas used for cogeneration).

Figure S5.4 shows Alberta’s total purchased, processed, and produced gas for oil sands operations.

Oil Sands Gas Use

In 2023

The oil sands sector used 105.8 106 m3/d (3.8 Bcf/d) of gas in 2023. In mining and upgrading in 2023, purchased gas use increased by 4% and processed gas by 6%.

Forecast for 2024 to 2033

Oil sands gas use is expected to reach 129.2 106 m3/d (4.6 Bcf/d) by 2033, a 22% increase from 2023. Although total gas use increases in line with bitumen production, the bulk of the incremental gas use is gas purchased for in situ bitumen recovery. In situ operations use a high volume of natural gas for steam generation and account for most of the bitumen production growth in the forecast, which triggers increased natural gas use for the sector.

Purchased Gas

Table S5.2 shows the average use rates of purchased gas for oil sands operations in 2023.

Learn More

- Methodology

- Data [XLSX]