December 2024

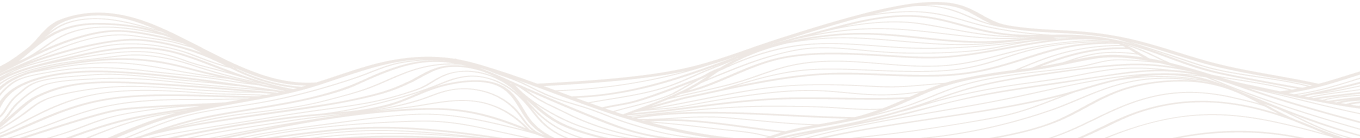

The orphan fund was established in the 1990s, and since 2002, the Orphan Well Association (OWA) manages the closure of orphaned oil and gas wells, pipelines, and facilities, including the reclamation of associated sites, across Alberta. Every year, the AER issues an orphan fund levy to licensees to ensure that the OWA has an operating budget (see figure 10).

The levy is used in part to pay for project closure costs when an energy company cannot meet its obligations to close its energy project safely and responsibly (see our Orphan Well Association webpage for further details). With the number of orphaned infrastructure and sites, the orphan fund levy has grown to accommodate larger budgets for completing closure work and administrative and operational costs. In 2023, the levy was increased to $135 million, almost doubling the previous year’s budget.

Figure 10. Orphan fund levy by year, 2009–2024

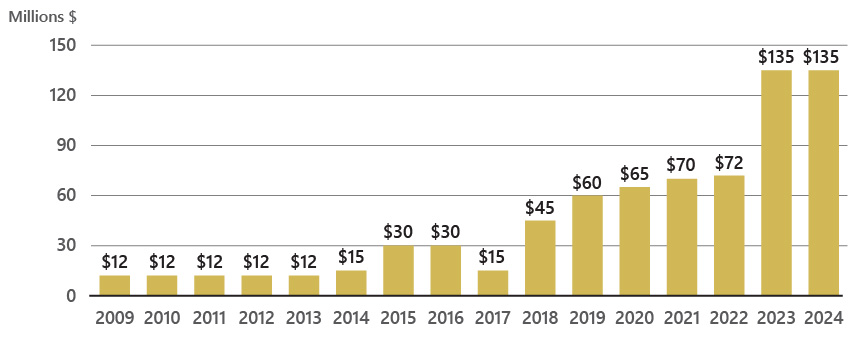

Figure 11 shows the OWA closure spend and milestones achieved. The OWA spent $185 million on closure in 2022 and decommissioned 1412 licences and reclaimed 361 licences. In 2023, the OWA spent $149 million on closure resulting in 828 decommissioned licences and 503 reclaimed licences.

Figure 11. Annual OWA closure spend and closure milestones achieved, 2020–2023

Source: Orphan Well Association (OWA). The OWA reports data in its annual report based on the fiscal year, whereas the AER reports on a calendar year.

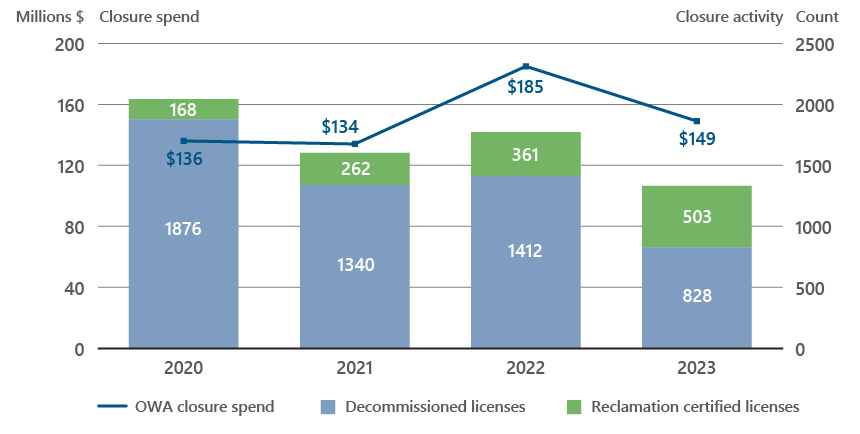

To uphold the current pace of closure activity, the 2024 orphan fund levy was maintained at $135 million. While the OWA continues to decommission many of the wells in its inventory, figure 12 shows that the number of wells remaining to be reclaimed (blue line) has increased. Reclamation timelines are significantly longer than decommissioning timelines and can range from 5 to 15 years depending on the area of the province, vegetation requirements, and the presence of any contamination.

Figure 12. OWA closure inventory by year, 2014–2023

Note: Data as of August 2024. The large increase in orphaned assets in 2019 is due to the Redwater decision, where receivers were provided additional direction and discharged many of their licenses into the OWA (e.g., Lexin). 2020–2022 included larger insolvencies such as Trident and Sequoia. The OWA tracks reclamation work by lease, whereas the AER tracks reclamation by licence. About half of the OWA leases awaiting reclamation are in the revegetation stage.

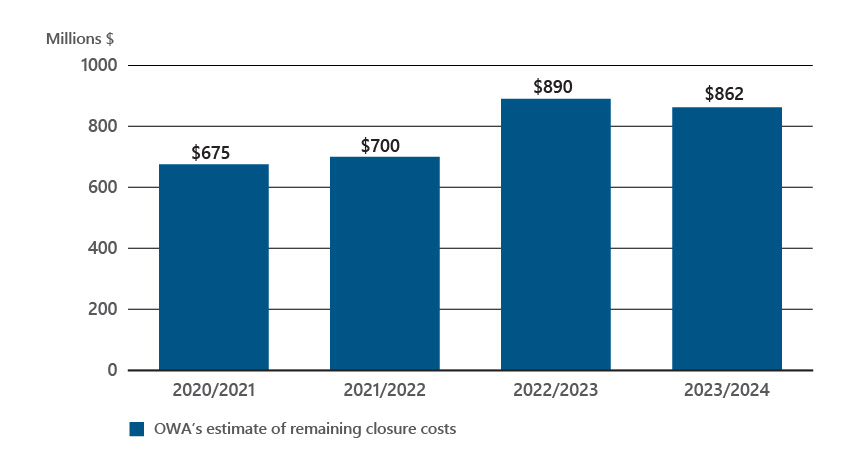

The OWA publishes annual reports summarizing their fiscal-year performance. Figure 13 shows their estimate of the remaining closure costs at the end of each fiscal year.

Figure 13. OWA’s estimate of remaining closure costs, 2020–2024

Note: This data retrieved from OWA’s annual reports and is based on a fiscal year (April 1 to March 31).