Updated June 2024

Within this section

Highlights of 2023

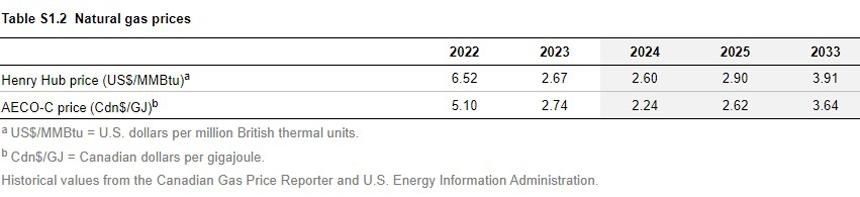

Henry Hub: The primary price benchmark for U.S. natural gas decreased by 59% in 2023, averaging US$2.67 per million British thermal units (MMBtu). The Henry Hub price decrease was attributed to elevated North American inventories and mild winter weather reducing natural gas demand. Solid production growth in North America also contributed to the price decline.

AECO-C: The AECO-C price, the benchmark for Western Canadian natural gas, decreased 46% from 2022 to an average of Cdn$2.74 per gigajoule (GJ) in 2023. The price decrease was primarily attributed to lower domestic residential and commercial demand and the growth in the natural gas supply.

Price differential: The price differential between Henry Hub and AECO-C narrowed to $0.52/MMBtu in 2023, down from US$2.38/MMBtu in 2022.

Table S1.2 shows the historical and forecast Henry Hub and AECO-C natural gas prices.

Highlights for 2024 to 2033

Henry Hub: The Henry Hub price is forecast to decline slightly to US$2.60/MMBtu in 2024 and rebound to US$3.91/MMBtu by 2033. Long-term demand is anticipated to increase, primarily driven by growth in U.S. domestic demand and exports.

AECO-C: The AECO-C price is forecast to decrease to Cdn$2.24/GJ in 2024 and rebound to Cdn$3.64/GJ by 2033.

Price differential: The price differential between AECO-C and Henry Hub reflects transportation costs, regional supply and demand balances, infrastructure constraints, and the U.S. and Canadian dollar exchange rate. The AECO-C and Henry Hub price differential is anticipated to average around US$0.83/MMBtu between 2024 and 2026 and is projected to widen slowly to US$0.91/MMBtu by 2033.