Updated June 2024

Summary

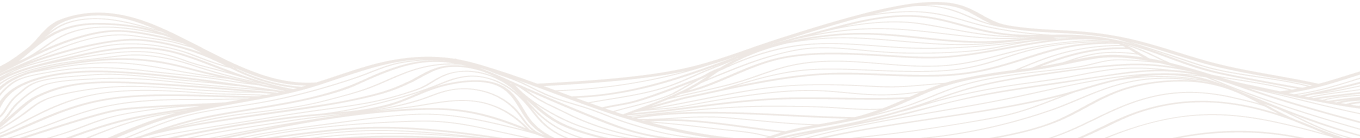

In 2023, total production of marketable coal decreased by 15% from 2022. As shown in Figure S7.1, subbituminous coal production from the Genesee mine is ramping down as the Capital Power Genesee generating station transitions to natural gas. The Genesee mine was scheduled to be decommissioned by the end of 2023; however, this has been delayed because of construction delays to the generating station’s repowering project. Capital Power will continue blending natural gas with coal for the commissioning of the repowered units in 2024. The Genesee mine will cease operations once the power station fully transitions to natural gas, estimated to occur in 2024.

Of the marketable coal produced in 2023,

- 27% was subbituminous,

- 67% was thermal bituminous, and

- 6% was metallurgical bituminous.

Subbituminous Coal

In 2023

Subbituminous coal production in Alberta accounts for 27% of the total marketable coal production in 2023. Production of subbituminous coal decreased by 38% in 2023 to 2.93 megatonnes (Mt). Coal production from the Genesee mine is ramping down as the Capital Power Genesee generating station transitions to natural gas. Several subbituminous coal mines have shut down and ceased operations in 2021 as coal-fired power plants converted to natural gas feedstock.

Forecast for 2024 to 2033

With the closure of the Genesee mine in 2024, subbituminous coal production will be down by 97% from 2023 levels. Subbituminous coal production is expected to be near zero in 2024, several years ahead of the legislated deadline for 2030. Rising carbon costs have played a significant role in Alberta’s transition away from coal-fired power generation. This outlook incorporates the Alberta Electric System Operator’s coal-to-gas conversion schedule forecast, featured in its most recent long-term outlook, and any recent updates announced by operators.

Metallurgical Bituminous Coal

In 2023

Production of marketable metallurgical bituminous coal (called coking coal) increased by 1% in 2023 to 0.71 Mt. The Grande Cache coal mine has been fully operational since its suspension and temporary closure in 2020 due to the pandemic.

Thermal Bituminous Coal

In 2023

Production of marketable thermal bituminous coal (called steaming coal) decreased by 3% in 2023 to 7.4 Mt. The Coal Valley mine is fully operational since its suspension and temporary closure in 2020 due to the pandemic.

Forecast for 2024 to 2033

In 2023, the Supreme Court of Canada ruled the designated projects section in the federal Impact Assessment Act, also known as Bill C-69, as unconstitutional. As a result, some coal companies have submitted applications for coal development in Alberta. In particular, the Mine 14 and the Vista Coal Mine Phase II Expansion coal projects will be allowed to undergo regulatory review because they are also exempt from a provincial ministerial order banning coal development in the Rockies. Therefore, we have included these two projects in our production forecast but consider them “risked,” as we expect delays in their obtaining regulatory approvals. The projection for bituminous coal production will grow slightly throughout the forecast period.

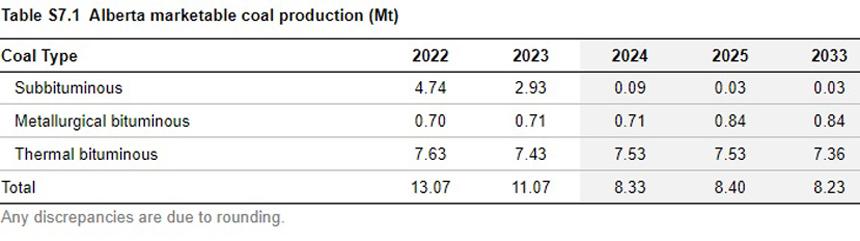

Table S7.2 lists the coal mines in Alberta and their marketable production in 2023.

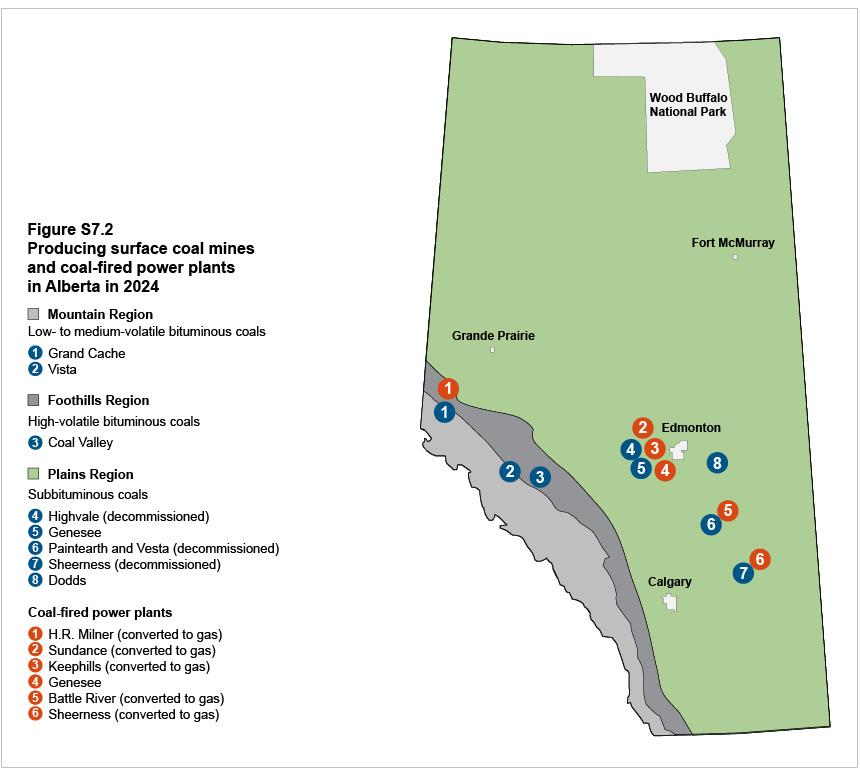

Figure S7.2 shows Alberta’s coal mines and the remaining coal-fired power plants. Genesee is the only coal-fired power plant remaining in Alberta. All other coal-fired power plants have been either converted to gas or decommissioned.

Learn More

- Methodology

- Data [XLSX]

- Resource Development Topics > Coal